montgomery county al sales tax

Montgomery County in Alabama has a tax rate of 65 for 2022 this includes the Alabama Sales Tax Rate of 4 and Local Sales Tax Rates in Montgomery County totaling 25. 334-625-2994 Hours 730 am.

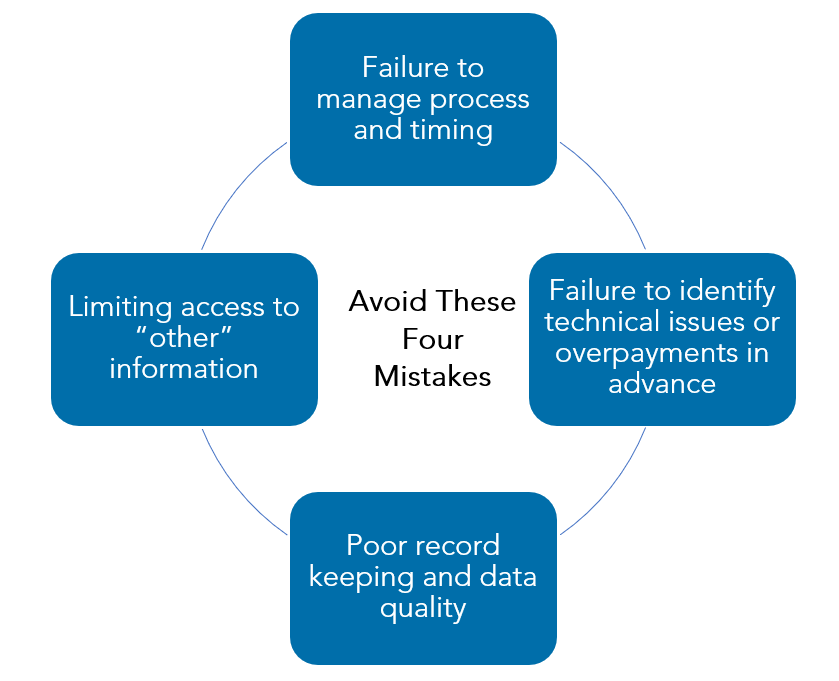

You Have Been Selected For Audit Most Frequently Asked Questions About Sales Tax Audits Answered Warren Averett Cpas Advisors

There is no applicable special tax.

. This document provides information and procedures relative to the June 14 2021 tax sale. A sales tax rate of 9 is the minimum minimum tax rate for all businesses located in Section Alabama in 2021. To review the rules in Alabama visit our state-by-state guide.

One of a suite of free online calculators provided by the team at iCalculator. 3 rows Montgomery County AL Sales Tax Rate The current total local sales tax rate in Montgomery. 4 rows Montgomery.

Montgomery AL 36104-1667 334 832-1250. Below is a listing by county of tax delinquent properties currently in State inventory. Many of these parcels have been acquired through tax foreclosure.

A county city and state sales tax rate can be added to this figure. The Montgomery County Alabama Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Montgomery County Alabama in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Montgomery County Alabama. The 10 sales tax rate in Montgomery consists of 4 Alabama state sales tax 25 Montgomery County sales tax and 35 Montgomery tax.

You can find more tax rates and allowances for Montgomery County. View How to Read County Transcript Instructions. All property will be sold as is with no warranty as to title or condition of the property.

License Revenue Division 25 Washington Avenue 3rd Floor Montgomery AL 36104 Phone. If you do not have one please contact Montgomery County at 334 832-1697 or via e-mail. Walk-in filing may be done at the following locations.

There is a 2 county sales tax rate. Tax sales are complex proceedings and the County recommends that individuals seek legal advice prior to participation in the annual tax sale. The Montgomery County Sales Tax is collected by the merchant on all qualifying sales made within Montgomery County.

Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land. The Montgomery County Alabama sales tax is 650 consisting of 400 Alabama state sales tax and 250 Montgomery County local sales taxesThe local sales tax consists of a 250 county sales tax. Contact the Montgomery County Alabama Tax Collectors Office ARS.

Box 4779 Montgomery AL 36103-4779. Alabama currently has a sales tax of 4. AL Sales Tax Rate.

Search Tax Delinquent Properties. 8 rows The Montgomery County Sales Tax is 25. Spear Montgomery County Revenue Commissioner PO.

To pay for the combined 2021 income and sales tax Montgomery Alabama must reduce its sales tax rate to 10. The current total local sales tax rate in Montgomery AL. The rate type is noted as Restaurant in MAT.

There is no applicable special tax. The Montgomery County Sales Tax is collected by the merchant on all qualifying sales made within Montgomery County. In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return your local taxpayer ID number assigned to you by these jurisdictions.

These tax sale procedures are unique to Montgomery County and may differ from those used in other Maryland counties. Residential Alabama 4201 Nordale Drive Montgomery AL 36116 Phone. Groceries are exempt from the Montgomery County and Ohio.

A county-wide sales tax rate of 25 is. The Montgomery County sales tax rate is 25. Instructions for Uploading a File.

The Alabama state sales tax rate is currently 4. The Montgomery County Alabama tax sale is held at 1000 AM in front of the Montgomery County Courthouse during the months of April and May of each year. In County there is a two percent sales tax.

Or 5340-B Atlanta Hwy. Transcripts of Delinquent Property. Each county has a different sales tax rate and each city has a different sales tax rate.

County SalesUse Tax co Sarah G. The Montgomery County Ohio sales tax is 725 consisting of 575 Ohio state sales tax and 150 Montgomery County local sales taxesThe local sales tax consists of a 150 county sales tax. The 2018 United States Supreme Court decision in South Dakota v.

For questions or assistance phone 334 832-1697. Since 2001 Alabama has been taxed at 4 on sales. The transcripts are updated weekly.

The Food Service Establishment Tax is a five percent 5 sales tax levied in lieu of the five 5 general sales tax on the gross proceeds of sales at retail of food andor beverages sold for consumption. 100 South Lawrence Street 3075 Mobile Hwy. 40-10-12 to verify the time and location of the Montgomery County Alabama tax sale.

What Is AlabamaS Sales Tax Rate 2021. Has impacted many state nexus laws and sales tax collection requirements.

Alabama Vehicle Sales Tax Fees Calculator Find The Best Car Price

Alabama Sales Tax Guide For Businesses

Alabama Sales Tax Guide And Calculator 2022 Taxjar

Chicago Now Home To The Nation S Highest Sales Tax Sales Tax Chicago Tax

Alabama Sales Tax Rates By City County 2022

Caperton S Old South Store Weogufka Al Old General Stores Sweet Home Alabama Olds

Bullet Hole Personal Injury Lawyer God S Heart Injury Lawyer

/cloudfront-us-east-1.images.arcpublishing.com/gray/URRWP6Z3GRHGZOODLFN26HP5NI.PNG)

Back To School Tax Free Weekend In Alabama

1861 English Legal Document Original Paper Ephemera Hand Etsy Paper Ephemera Old Paper Paper

Alabama Sales Tax Guide For Businesses

Updated Fish River Nearing Flood Stage Fairhope Flood River

The 1 Reason To Sell Your House Today In 2022 Selling Your House Things To Sell Sale House

Sales Tax Audit Montgomery County Al

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com